Categories

Selling the call obligates you to sell stock you already own at strike price A if the option is assigned. Some investors will run this strategy after they’ve already seen nice gains on the stock...

Purchasing a protective put gives you the right to sell stock you already own at strike price A. Protective puts are handy when your outlook is bullish but you want to...

Buying the put gives you the right to sell the stock at strike price A. Because you’ve also sold the call, you’ll be obligated to sell the stock at strike price B if the option is assigned...

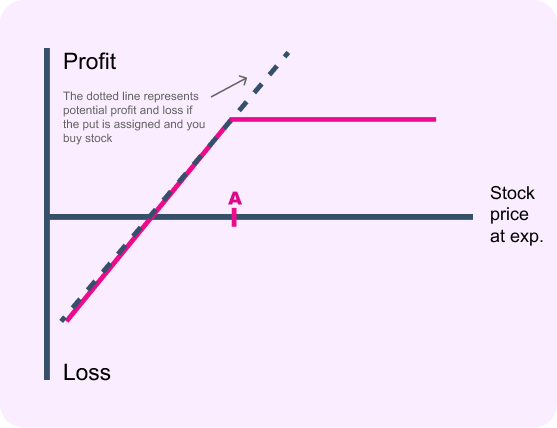

Selling the put obligates you to buy stock atstrike price A if the option is assigned. In this instance, you’re selling the put with theintention of buying the stock after the put isassigned...

A long call gives you the right to buy the underlying stock at strike price A. Calls may be used as an alternative to buying stock outright. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock.

A long put gives you the right to sell the underlying stock at strike price A. If there were no such thing as puts, the only way to benefit from a downward movement in the market would be to sell stock short.

Buying the LEAPS call gives you the right to buy the stock at strike A. Selling the call at strike B obligates you to sell the stock at that strike price if you’re assigned...

A long call spread gives you the right to buy stock at strike price A and obligates you to sell the stock at strike price B if assigned. This strategy is an alternative to buying a long call . Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A...

A long put spread gives you the right to sell stock at strike price B and obligates you to buy stock at strike price A if assigned. This strategy is an alternative to buying a long put...

A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B...

A short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A....

A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. But those rights don’t come cheap...

A long strangle gives you the right to sell the stock at strike price A and the right to buy the stock at strike price B...

This is an interesting and unusual strategy. Essentially, you’re selling an at-the-money short call spread in order to help pay for the extra out-of-the-money long call at strike B.

This is an interesting and unusual strategy. Essentially, you’re selling an at-the-money short put spread in order to help pay for the extra out-of-the-money long put at strike A.

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. You’re taking advantage of accelerating time decay on the front-month (shorter-term) call as expiration approaches...

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. You’re taking advantage of accelerating time decay on the front-month (shorter-term) put as expiration approaches...

You can think of this as a two-step strategy. It’s a cross between a long calendar spread with calls and a short call spread . It starts out as a time decay play...

You can think of this as a two-step strategy. It’s a cross between a long calendar spread with puts and a short put spread . It starts out as a time decay play...

A long call butterfly spread is a combination of a long call spread and a short call spread, with the spreads converging at strike price B.

A long put butterfly spread is a combination of a short put spread and a long put spread , with the spreads converging at strike B...

You can think of this strategy as simultaneously running a short put spread and a short call spread with the spreads converging at strike B. Because it’s a combination of short spreads, an iron butterfly can be established for a net credit...

You can think of this strategy as embedding a short call spread inside a long call butterfly spread . Essentially, you’re selling the short call spread to help pay for the butterfly. Because establishing those spreads separately would entail both buying and selling a call with strike C, they cancel each other out and it becomes a dead strike...

You can think of this strategy as embedding a short put spread inside a long put butterfly spread . Essentially, you’re selling the short put spread to help pay for the butterfly. Because establishing those spreads separately would entail both buying and selling a put with strike B, they cancel each other out and it becomes a dead strike...

You can think of this strategy as a back spread with calls with a twist. Instead of simply running a back spread with calls (sell one call, buy two calls), selling the extra call at strike D helps to reduce the overall cost to establish the trade.

You can think of this strategy as a back spread with puts with a twist. Instead of simply running a back spread with puts (sell one put, buy two puts), selling the extra put at strike A helps to reduce the overall cost to establish the trade.

You can think of this strategy as simultaneously buying one long call spread with strikes A and C and selling two short call spreads with strikes C and D. Because the long call spread skips over strike B...

You can think of this strategy as simultaneously buying one long put spread with strikes D and B and selling two short put spreads with strikes B and A. Because the long put spread skips over strike C...

You can think of a long condor spread withcalls as simultaneously running an in-the-money long call spread and an out-of-the-money short call spread . Ideally, you want the short call spread to expire worthless, while the long call spread achieves its maximum value with strikes A and B in-the-money...

You can think of put condor spread as simultaneously running an in-the-money short put spread and an out-of-the-money long put spread . Ideally, you want the short put spread to expire worthless, while the long put spread achieves its maximum value with strikes C and D in-the-money.

You can think of this strategy as simultaneously running an out-of-the-money short put spread and an out-of-the-money short call spread . Some investors consider this to be a more attractive strategy than along condor spread with calls or puts because you receive a net credit into your account right off the bat...

Selling the call obligates you to sell stock at strike price A if the option is assigned. When running this strategy, you want the call you sell to expire worthless. That’s why most investors sell out-of-the-money options ..

Selling the put obligates you to buy stock at strike price A if the option is assigned. When selling puts with no intention of buying the stock, you want the puts you sell to expire worthless. This strategy has a low profit potential if the stock remains above strike A at expiration...

A short straddle gives you the obligation to sell the stock at strike price A and the obligation to buy the stock at strike price A if the options are assigned. By selling two options, you significantly increase the income you would have achieved from selling a put or a call alone...

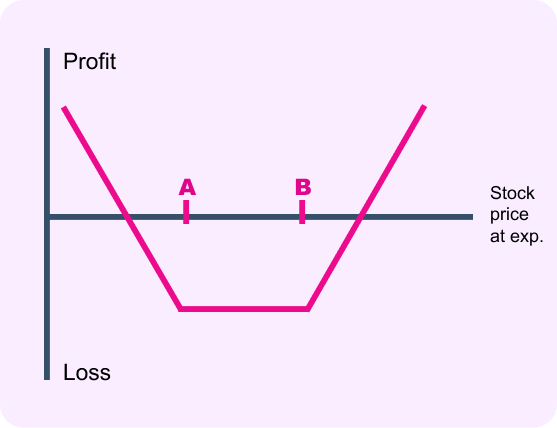

A short strangle gives you the obligation to buy the stock at strike price A and the obligation to sell the stock at strike price B if the options are assigned. You are predicting the stock price will remain somewhere between strike A and strike B, and the options you sell will expire worthless...

Buying the call gives you the right to buy the stock at strike price A. Selling the put obligates you to buy the stock at strike price A if the option is assigned. This strategy is often referred to as “synthetic long stock” because the risk / reward profile is nearly identical to long stock...

Buying the put gives you the right to sell the stock at strike price A. Selling the call obligates you to sell the stock at strike price A if the option is assigned. This strategy is often referred to as “synthetic short stock” because the risk / reward profile is nearly identical to short stock.

Buying the call gives you the right to buy stock at strike price A. Selling the two calls gives you the obligation to sell stock at strike price B if the options are assigned. This strategy enables you to purchase a call that is at-the-money or slightly out-of-the-money without paying full price.

Buying the put gives you the right to sell stock at strike price B. Selling the two puts gives you the obligation to buy stock at strike price A if the options are assigned. This strategy enables you to purchase a putth at is at-the-money or slightly out-of-the-money without paying full price.

At the outset of this strategy, you’re simultaneously running a diagonal call spread and a diagonal put spread . Both of those strategies are time-decay plays. You’re taking advantage of the fact that the time value of the front-month options decay at a more accelerated rate than the back-month options...