Cash-Secured Put

The strategy

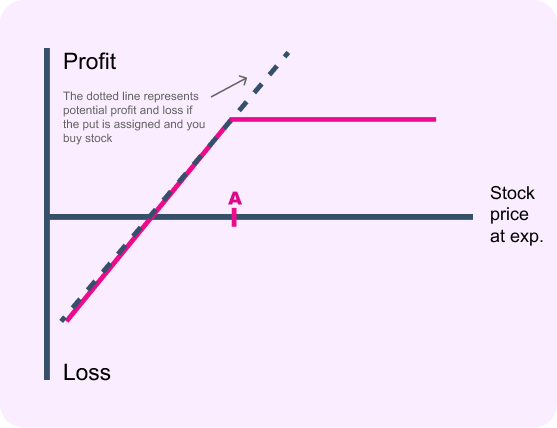

Selling the put obligates you to buy stock at strike price A if the option is assigned.

In this instance, you’re selling the put with the intention of buying the stock after the put is assigned. When running this strategy, you may wish to consider selling the put slightly out-of-the-money . If you do so, you’re hoping that the stock will make a bearish move, dip below the strike price, and stay there. That way the put will be assigned and you’ll end up owning the stock. Naturally, you’ll want the stock to rise in the long-term.

The premium received for the put you sell willl ower the cost basis on the stock you want to buy. If the stock doesn’t make a bearish move by expiration, you still keep the premium for selling the put. That’s sort of nice, because it’s one of the few instances when you can profit by being wrong.