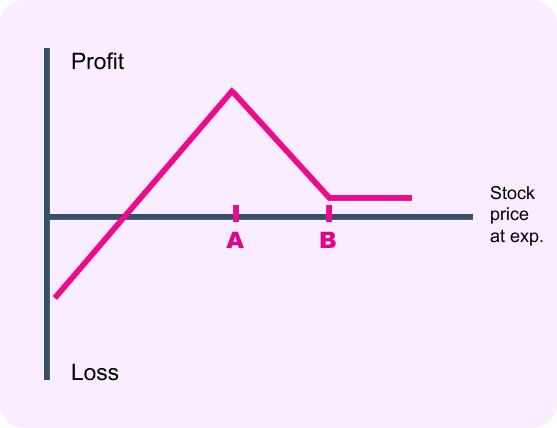

Short Strangle

The strategy

A short strangle gives you the obligation to buy the stock at strike price A and the obligation to sell the stock at strike price B if the options are assigned. You are predicting the stock price will remain somewhere between strike A and strike B, and the options you sell will expire worthless.

By selling two options, you significantly increase the income you would have achieved from selling a put or a call alone. But that comes at a cost. You have unlimited risk on the upside and substantial downside risk. To avoid being exposed to such risk, you may wish to consider using an iron condor instead.

Like the short straddle , advanced traders might run this strategy to take advantage of a possible decrease in implied volatility. If implied volatility is abnormally high for no apparent reason, the call and put may be overvalued. After the sale, the idea is to wait for volatility to drop and close the position at a profit.