Protective Put

The strategy

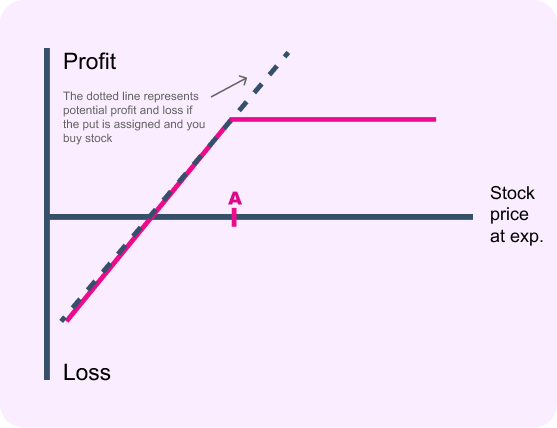

Purchasing a protective put gives you the right to sell stock you already own at strike price A. Protective puts are handy when your outlook is bullish but you want to protect the value of stocks in your portfolio in the event of a down turn. They can also help you cut back on your antacid intake in times of market uncertainty.

Protective puts are often used as an alternative to stop orders. The problem with stop orders is they sometimes work when you don’t want them to work, and when you really need them they don’t work at all. For example, if a stock’s price is fluctuating but not really tanking, a stop order might get you out prematurely.

If that happens, you probably won’t be too happy if the stock bounces back. Or, if a major news event happens overnight and the stock gaps down significantly on the open, you might not get out at your stop price. Instead, you’ll get out at the next available market price, which could be much lower.

If you buy a protective put, you have complete control over when you exercise your option, and the price you’re going to receive for yours tock is predetermined. However, these benefits do come at a cost. Whereas a stop order is free, you’ll have to pay to buy a put. So it would be nice if the stock goes up at least enough to cover the premium paid for the put.

If you buy stock and a protective put at the same time, this is commonly referred to as a “married put.” For added enjoyment, feel free to play a wedding march and throw rice while making this trade.

Options guys tips

Many investors will buy a protective put when they’ve seen a nice run-up on the stock price, and they want to protect their unrealized profits against a downturn. It’s sometimes easier to part with the money to pay for the put when you’ve already seen decent gains on the stock.