Covered Call

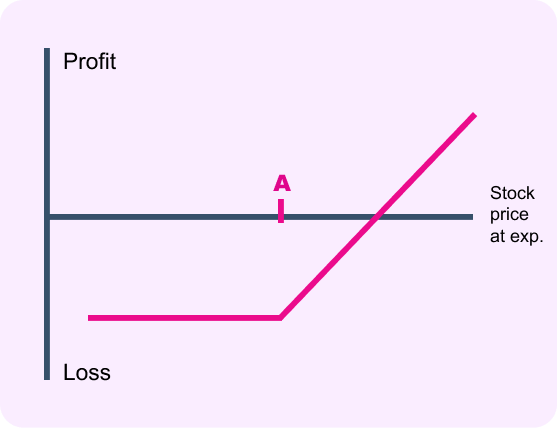

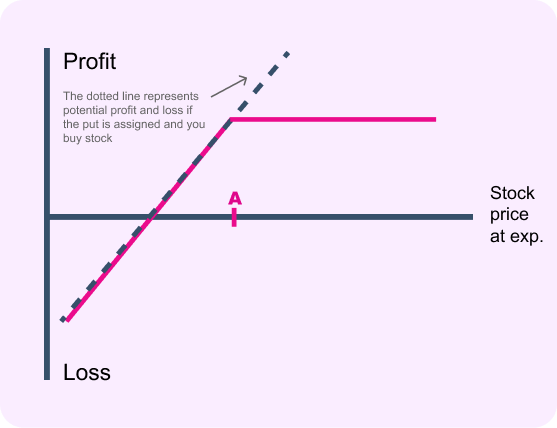

NOTE: This graph indicates profit and loss at expiration, respective to the stock value when you sold the call.

The strategy

Selling the call obligates you to sell stock you already own at strike price A if the option is assigned.

Some investors will run this strategy after they’ve already seen nice gains on the stock. Often, they will sell out-of-the-money calls, so if the stock price goes up, they’re willing to part with the stock and take the profit.

Covered calls can also be used to achieve income on the stock above and beyond any dividends. The goal in that case is for the options to expire worthless.

If you buy the stock and sell the calls all at the same time, it’s called a ”Buy / Write.” Some investors use a Buy / Write as a way to lower the cost basis of a stock they’ve just purchased.

Options guys tips

As a general rule of thumb, you may wish to consider running this strategy approximately30-45 days from expiration to take advantage of accelerating time decay as expiration approaches. Of course, this depends on the underlying stock and market conditions such as implied volatility .

You may wish to consider selling the call with a premium that represents at least 2% of the current stock price (premium ÷ stock price).But ultimately, it’s up to you what premium will make running this strategy worth your while.

Beware of receiving too much time value. If the premium seems abnormally high, there’s usually a reason for it. Check for news in the marketplace that may affect the price of the stock. Remember, if something seems too good to be true, it usually is.