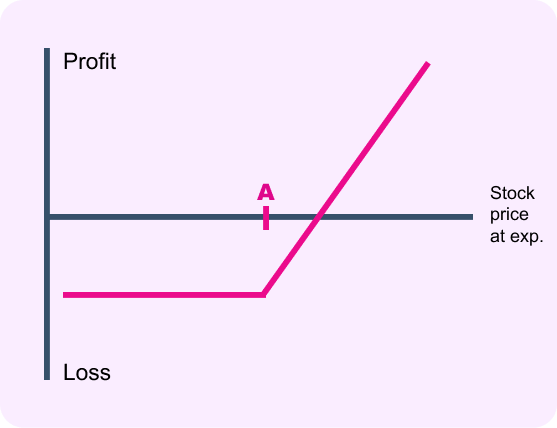

Long Put

The strategy

A long put gives you the right to sell the underlying stock at strike price A. If there were no such thing as puts, the only way to benefit from a downward movement in the market would be to sell stock short. The problem with shorting stock is you’re exposed to theoretically unlimited risk if the stock price rises.

But when you use puts as an alternative to short stock, your risk is limited to the cost of the option contracts. If the stock goes up (the worst-case scenario) you don’t have to deliver shares as you would with short stock. You simply allow your puts to expire worthless or sell them to close your position (if they’re still worth anything).

But be careful, especially with short-term out-of-the-money puts. If you buy too many option contracts, you are actually increasing your risk. Options may expire worthless and you can lose your entire investment.

Puts can also be used to help protect the value of stocks you already own. These are called protective puts .